Services

For businesses in multiple industries

looking to reduce Federal and State tax liability.

"*" indicates required fields

The R&D tax credit, also known as the Research and Development tax credit, was created as a way to incentivize U.S. based research and development activity. The Protecting Americans from Tax Hikes (PATH) Act in 2015 made this a permanent tax credit and extended the benefits to startup companies. The credit enables businesses of all sizes to reduce their federal income tax for qualified research expenses. These expenses must be for qualified research activities.

Claiming the R&D tax credit can potentially result in significant cost savings. The benefits include:

A taxpayer can claim an R&D tax credit, on their timely filed tax return including extensions for a given year and a taxpayer can amend prior returns to claim the credit. For amended tax returns, this can typically be claimed for the previous 3 years.

The credit is claimed by filing IRS Form 6765, Credit for Increasing Research Activities (for the year in which the qualified expenses were paid or incurred).

Qualified Research Activities include but are not limited to the following:

The Protecting Americans from Tax Hikes (PATH) Act of 2015 included provisions that allow small and mid-sized taxpayers to offset their Alternative Minimum Tax (AMT) liability with the R&D tax credit for taxable years beginning on or after Jan 1, 2016.

Previously, qualified companies could be limited by AMT and unable to utilize 100% of the R&D tax credit. Instead, any excess credits had to be carried back and then forward. However, the PATH Act makes it possible for small businesses to offset their Alternative Minimum Tax through the R&D tax credit. So for tax years beginning after December 31, 2015, there is no limitation.

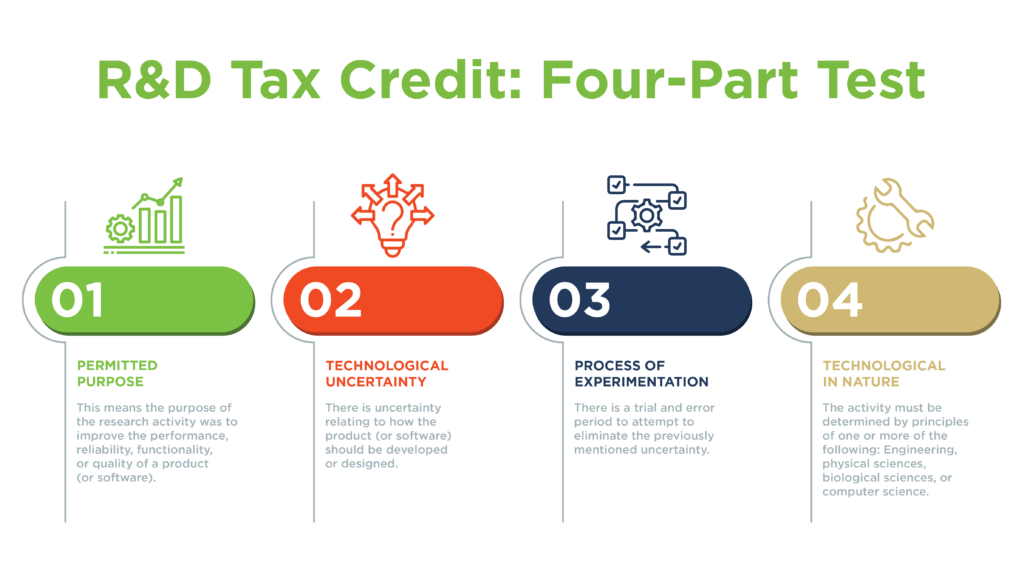

Documentation is extremely important to defending any R&D tax credit claims. This includes having a permitted purpose, technological uncertainty, the process of experimentation, and being technological in nature.

There is a Four-Part Test for qualification of the R&D credit as seen below:

There are two methods a taxpayer can choose from when computing the R&D tax credit: The Regular Credit (RC) Method and the Alternative Simplified Credit (ASC) Method. Taxpayers can generally choose the most beneficial calculation method each year.

Both methods offer specific advantages and disadvantages. Our team at Source Advisors can determine the best calculation method based on your specific situation.

There are four sections of IRS Form 6765 that must be evaluated:

The first section is for any business attempting to claim the R&D credit using the RC method.

This section is for businesses electing to utilize the ASC calculation method.

This section contains further documentation based on your specific business setup.

This section is required for any small business that falls under the payroll tax election.

Source advisors assists taxpayers in identifying departments and cost center where Section 174 R&E activities are taking place.

Often our R&D Tax Studies are augmented with 174 Amortization studies to ensure compliance and to help reduce tax liability.

The R&D tax credit can help a wide variety of businesses offset and reduce their income tax liability, in addition to providing many other benefits. At Source Advisors, we can help assess your company’s federal R&D tax credit opportunity and also determine any state R&D tax credit availability. Our team of experienced CPAs, attorneys, engineers, and technology experts helps companies save money and create cash flow with R&D tax credits that can then help drive overall growth.

The Research and Development (R&D) Tax Credit is a business incentive that can be used to reduce a company’s federal income tax liability. It is available to businesses that are engaged in the development of new or improved products, processes, software, techniques, or formulations. To qualify for this credit, taxpayers must have incurred expenses related to qualified research activities.

The R&D Tax Credit is claimed by filing it on a timely submitted tax return, which can include extensions. This credit can also be retroactively claimed on amended tax returns, typically for up to the previous three tax years. To report the credit, businesses need to complete IRS Form 6765, titled “Credit for Increasing Research Activities,” for the tax year in which the qualified expenses were incurred. For business entities such as Sub-S Corporations and LLCs, the credit is passed through to the shareholders, who then report it on their individual Schedule K-1 forms.

Learn More

Request an enhanced R&D Tax Credit study that includes a Section 174 study to ensure compliance and to help reduce tax liability

Read More →

Automate your R&D tax credits with GOAT.tax

Read More →

We help businesses based in the UK claim R&D Tax Credits

Read More →